This one's a different Nahar

Jun-05: Sales increased to 176 crs from 90 crs LY; profits up from 3 crs to 14 crs

Sep-05: Sales up from 82 crs to 172 crs; profits rose from 7.12 to 15.07 crs

Dec-05: Sales upto 169 crs (from 156 crs); profits up from -0.72 to 18.26 crs.

Extrapolating these numbers over the next 3 quarters puts the fwdPE of the company at a powerful 8.56. I also find that -

1. The organisation's interest cost has been decreasing over the last few quarters, which is brillant. (there is one news item however, which indicates that the company is in discussion for issue of FCCBs)

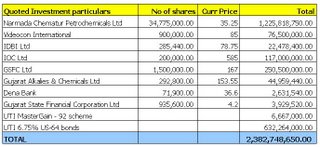

2. The NCAV of the scrip is 13.92 with a sizable investment head of 66 crs in the balance sheet (mostly owing to shares in sister concerns - NSML and NEL)

3. A visible increase in net margin from -1.5% in FY2004, 3.3% in FY2005 and 9.2% till Dec-05

4. Surprisingly, no dividend has yet been issued although the company has enough cash reserves and cash profits.

5. The 31-Mar-05 book value is a comfortable 175 rupees/share

I would love to buy this stock. The only hitch on the charting is : the scrip had just created a valley a few days back when it dipped from 170 rupees to 130 rupees. It's now back to 170 rupees. Dont risk market timing ... buy a small number of shares, buy more on declines.