GNFC Ltd

Share Capital - 146.48 crs

Loans - 299.08 crs

Investment - 218.05 crs

Net CA - 292.47 crs

FV - 10 rupees per share

Dividend - 3.75 rupees per share

CMP - 115.00 rupees per share

LY Profits - 224.20 crs

Examining the balance sheet and the financial statements, I find -

1. The estimated profits for this year would be 270 crs which means a fwdPE of 6.24. Consequently, the sales have been growing at 12% over LY while profits are up, 30% over LY.

4. NCAV for the scrip (excl investments) is negative 0.05. By including liquid investments (and only 70% of it; I am keeping the remaining 30% as buffer for any plausible reduction in value), then NCAV comes to 14.43 rupees per share.

Finally, news value ... the big news for the company is the merger of the company with it's subsidary, Narmada Chematur Petrochemicals Ltd. The merger proposal was cleared on 2-Mar-2006.

On first count, it seems that this merger is not likely to disturb shareholder value of GNFC. Some reasons are enclosed -

1. NCPL is a profitable company with positive and growing profits QonQ.

2. Amazingly, the current dividend yield and the P/E ratio of this subsidary are better than GNFC (4.26%, 7.21)

3. A consolidated picture would thus be something like -

a) The GNFC share capital would increase by 20.54 crs to 167.02 crs

b) PAT for this year for the combined corporation would close at 300 crs. Thus the fwdPE would be 6.40.

It's a buy from my end with a stop loss at 100 rupees. But also look at NCPL ... seems to be some kind of arbitrage here ...

An arbitrage opportunity :

For every 3 NCPL share, one gets 1 GNFC share. Now GNFC is at 115 rupees and NCPL is at 35 rupees. Which means, if I purchase 3 shares of NCPL at 35 rupees each, my purchase cost would be 105 rupees. And when it gets converted to 1 share of GNFC, the same 105 would be worth 115 rupees. There are many a caveat to this ... but on the face of it, it's almost risk-free.

4 Comments:

Today (3-Apr), NCPL is available at 36.20 while GNFC is 120.40. 3 shares of NCPL (which is equal to one share of GNFC) is available at 108.60 rupees. A clear savings of 11.80 rupees or 10.86%.

Shankar,

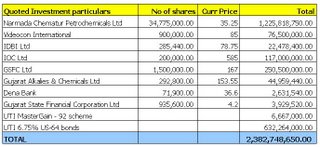

Your research is really good. Please find some details which I got from Geojit.

NCPL.

The share capital has remained constant at 61.62 crores

1. The Debt has been reducing

Mar05 = 67.68cr Mar04 = 127.34cr Mar03 = 172.83cr Mar02 = 210.86cr Mar01 = 236.50cr

NCA shown for Mar05 is -ve at

-38.35cr.

EPS

First half 05-06 is 1.3

Third Quarter 05-06 is 1.84

Approx EPS for 4th Quarter 1.85

Total EPS = 5.

Price as on 07Apr06 = 37.75

P/E = 7.55

Profits in cr.

Mar05=30.53 Mar04=11.25 mar03=16.98 Mar02=11.67 Mar01=18.43

Last 3 Quarters profit is 19.4cr

(1Q=2.4cr, 2Q=6cr, 3Q=11cr)

P & L Bal. carried down cr.

Mar05=45.39 Mar04=26.93 Mar03=19.15 Mar02=8.13 Mar01=-2.66

Current Ratio not very good = 0.46

Debt/Equity Ratio is good = 0.61

I think NCPL is a good buy as for 3 shares we will get 1 share of GNFC as you mentioned above.

Also checked the results for GNFC, nice results.

-Amol.

Shankar,

I am going ahead with the buying of NCPL to get an entry into GNFC :-). I think the current price 37-38 is fine.

-Amol.

Buy now. At 38 rupees, you would save 12 rupees for a share of GNFC

Warm Rgds, Shankar

Post a Comment

<< Home