Reading a company - Hindustan Constructions

My observations -

a) The co. has a rather heavy loan amt in its books - 425.68 crs. The financial expenses incurred for servicing this debt was 54.19 crs. This becomes interesting when you observe that the company has been increasing it's debt input every year .. even more interesting when compared with the interest paid in servicing these debts under "financial expenses" in the P&L

statement.

2002 - Loan : 322 crs; Interest : 30.58 crs; Servicing : 9.50%

2003 - Loan : 379 crs; Interest : 50.90 crs; Servicing : 13.41%

2004 - Loan : 419 crs; Interest : 48.11 crs; Servicing : 11.47%

2005 - Loan : 425 crs; Interest : 54.19 crs; Servicing : 12.73%

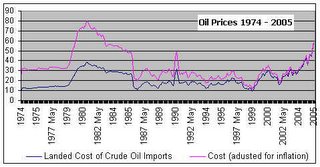

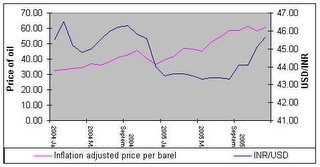

Questions - Why does the loan rate increase in 2003, 2004 when the borrowing rates were it's lowest ever?

b) Look at the tax charges. You might find it unbelievable !!!

In March 2002, the company paid a tax charge of 48% on the profit before tax (PBT). In March 2005, the company paid just 9%. Two extremes.

c) Investments for FY2005 are placed at 189.92 crs. An analysis of the investments schedule in page 16 of the annual report reveals -

1. A significant portion of the investments (approx 51 crs) have been apportioned with Lavasa Corp. Ltd. - a 50% subsidiary of HCC.

2. Their exposure in MF is 130.74 crs and in a few equity shares of other companies. An interesting aspect was that a share like Hindustan Oil Exploration Ltd. (104400 shares) they hold is accounted at rupees 10 in their books while the CMP (31-Jan) in the market is 1342 rupees. The total (MF plus shares) is at 135.81 crores.

d) The company holds a cash balance of 3.81 rupees per share, so the dividend for the year can be as high as 90 paise. That will mean a dividend yield of 0.69%. This is low.

e) Q1, Q2 and Q3 for the company have been extremely good. Together they have closed at 81.3 crs. The big job is to predict the income numbers for Q4. Some points here -

1. As mentioned, financial charges for FY2005 was 54 crores. However in Q1, Q2 and Q3 of this year (all put together) only 32.8 crs have been accounted. So a huge chunk of 23-25 crores will be used in Q4.

2. Tax charges - Q1 plus Q2 plus Q3 equals only 10.7 crs. Even if I assume a tax charge of only 20% on PBT, I am looking at a tax of atleast 19 crs for Q4.

3. Extrapolating numbers (Q4 has been the best for HCC over the last two years), I would work out the PBIT to 58 crs. Cut an interest of 24 crs and a tax charge of 19 crs, my understanding of PAT should be 15 crs. Which would close the year for HCC at:

- PAT: 96.25 crs (a growth of 26% over LY)

- P/E: 35.51 (at todays CMP)

There is one important rule that Graham has always said (read: Intelligent Investor), "if you cant read the annual report of the company then you have no place in researching and investing in a stock. You are better off giving it to a mutual fund"

On reading the annual report (FY2005), I found the following statements you would be interested in -

1. This will confuse you ... on page 5, to the profit after tax, the management has added "Excess Tax Provision of earlier years written back" (and we here are discussing that the company is not paying enough taxes)

2. The total balance value of work on hand as on March 31, 2005 is Rs. 5381 crore including CompanyÂs share in the Integrated Joint Venture Projects.

The latest news item (Jan 24th 2006): "Hindustan Construction Company Ltd has informed that the Company has been awarded a contract for Rs 3,959 million from National Hydroelectric Power Corporation Ltd, Faridabad for Civil Works Package (Lot-I) (Construction of Diversion Arrangement, Concrete Gravity Dam Along with Spillway, Roller Compacted Concrete (RCC) Dam, Intake Structure, Surface Power House, Tail Race Channel, Switch Yard and Other Associated Civil Works) of Teesta Low Dam HE Project, Stage-IV (4x40 MW), West Bengal."

I took up this stock as a study of "how to read a company". However, the writing on the wall says : Is 149 rupees a good price to pay for this stock?