Oil prices - where is it headed?

Increase in oil prices always has an inflationary effect on the economy. Worse still, this effect pans across the globe affecting each country which has energy requirements. Consulting firm, Delloites has some good views on the rising oil prices. The most striking part of the article posted in their website was on reasons why the world economies have been able to withstand the rise-in-oil-price blow. Here's their view-

1. A number of economies are not dependent on energy driven sectors like manufacturing alone which is true fro countries like the US and India where services is the predominant sector over agriculture and manufacturing whose energy requirements are higher.

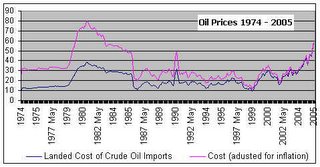

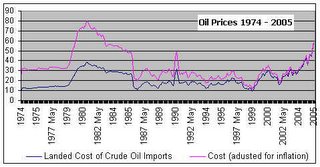

2. The price of oil is not as high as it was in the late 1970s and early 1980s when adjusted for inflation. I have put together a graph on the same. Infact the highest price of oil per barrel was $80.69 in Feb-1981 and lowest point being Dec-1998 when the price of oil was just 9.3 USD to the barrel and the inflation-adjusted price was 11.47 USD. From there the price of oil has come a lot, but not equal to what it was 25 years back

2. The price of oil is not as high as it was in the late 1970s and early 1980s when adjusted for inflation. I have put together a graph on the same. Infact the highest price of oil per barrel was $80.69 in Feb-1981 and lowest point being Dec-1998 when the price of oil was just 9.3 USD to the barrel and the inflation-adjusted price was 11.47 USD. From there the price of oil has come a lot, but not equal to what it was 25 years back

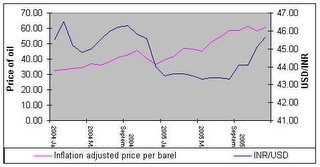

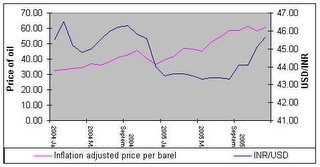

3. There has been a decline in the value of the dollar. This means, the price you pay for one barrel of oil will come down if the USD/INR exchange rate has gone down ceteris paribus. E.g. Between Oct 2004 to Dec 2004, the USD fell by almost 4% and the oil prices too fell by a sparkling 19%. Thus the impact on the oil bill was -

barrel of oil will come down if the USD/INR exchange rate has gone down ceteris paribus. E.g. Between Oct 2004 to Dec 2004, the USD fell by almost 4% and the oil prices too fell by a sparkling 19%. Thus the impact on the oil bill was -

Oct 2004 - Cost of purchase of 1 barrel = 2020.38 INR

Dec 2004 - Cost of purchase of 1 barrel = 1554.96 INR

4. There was also a time lag between people awakening to the fact that the rise in oil prices was not a temporary blip. It often happens across all industries and almost all situations.

5. Another striking part of the oil price rise, is that this one is demand-driven rather than it being supply driven. The larger consumers of oil are developing countries like India and China. With their economies growing at 7+%, these people will not raise a hue and cry over it.

All this may reverse if the following happen -

- China, India grow into energy guzzling monsters

- The USD for some reason appreciates vis-a-vis other currencies. (this will raise the import bill of oil for all countries)

1. A number of economies are not dependent on energy driven sectors like manufacturing alone which is true fro countries like the US and India where services is the predominant sector over agriculture and manufacturing whose energy requirements are higher.

2. The price of oil is not as high as it was in the late 1970s and early 1980s when adjusted for inflation. I have put together a graph on the same. Infact the highest price of oil per barrel was $80.69 in Feb-1981 and lowest point being Dec-1998 when the price of oil was just 9.3 USD to the barrel and the inflation-adjusted price was 11.47 USD. From there the price of oil has come a lot, but not equal to what it was 25 years back

2. The price of oil is not as high as it was in the late 1970s and early 1980s when adjusted for inflation. I have put together a graph on the same. Infact the highest price of oil per barrel was $80.69 in Feb-1981 and lowest point being Dec-1998 when the price of oil was just 9.3 USD to the barrel and the inflation-adjusted price was 11.47 USD. From there the price of oil has come a lot, but not equal to what it was 25 years back3. There has been a decline in the value of the dollar. This means, the price you pay for one

barrel of oil will come down if the USD/INR exchange rate has gone down ceteris paribus. E.g. Between Oct 2004 to Dec 2004, the USD fell by almost 4% and the oil prices too fell by a sparkling 19%. Thus the impact on the oil bill was -

barrel of oil will come down if the USD/INR exchange rate has gone down ceteris paribus. E.g. Between Oct 2004 to Dec 2004, the USD fell by almost 4% and the oil prices too fell by a sparkling 19%. Thus the impact on the oil bill was -Oct 2004 - Cost of purchase of 1 barrel = 2020.38 INR

Dec 2004 - Cost of purchase of 1 barrel = 1554.96 INR

4. There was also a time lag between people awakening to the fact that the rise in oil prices was not a temporary blip. It often happens across all industries and almost all situations.

5. Another striking part of the oil price rise, is that this one is demand-driven rather than it being supply driven. The larger consumers of oil are developing countries like India and China. With their economies growing at 7+%, these people will not raise a hue and cry over it.

All this may reverse if the following happen -

- China, India grow into energy guzzling monsters

- The USD for some reason appreciates vis-a-vis other currencies. (this will raise the import bill of oil for all countries)

2 Comments:

Hi shankar

came across your blog recently and found a number of interesting posts.you seem to be a keen follower of graham's philosophy. I personally lean more towards buffett than graham. The reason being that graham type value stocks in india seem to be small cap and i find it difficult to trust these companies and their promoters (with SEBI being what it is ). even when i have found companies selling below cash value (you may to look at Kothari products ), i have been wary of investing, because i cannot be sure if the management would not blow the cash away. Also the M&A market which can bring out such deep value stocks seems to be weak in india.

i found some posts on scrips in which i was interested in the past such as Karur vyasa , BSES etc.

I am not sure why you are looking at NCA for a bank or a financial institution. I would assume the CA for a bank is more like inventory which would be cycled into FG (long term loans or investment)

btw ...i have run my own blog - http://valueinvestorindia.blogspot.com/

good to come across like minded investors

what you are saying is true rohit. i must be true with you, i have some 4-5 dirt stocks which are of the small scrips cadre. One of them pinches me - padmalaya tele - it's lingering at 20 rupees. my cost of acquisition was 50 rupees. there was/is good value but the management folded.

mid cap stocks are preferable. i have noticed some trends in value mid cap stocks -

1. there is a consistent increase in the net current assets of these stocks yoy

2. slight increase in debt yoy

3. increase in investments yoy

4. tax charges are between 20%-30%

5. sales growth is modest and so is the profits growth

these invariably give good value.

Post a Comment

<< Home