To NRIs with love

I came across on a fabulous presentation "Revisiting FX as an Asset Class" (366 Kb) by Stephane Targui from the Corporate and Investment Banking division of BNP Paribas. Presented were a number of FX related structured product investments which I thoroughly enjoyed. One observation, which may be of good information to NRIs and foreign citizens is the limited use of plausible ‘risks’ in the pitch. These however were conveniently stashed away as part of the disclaimer.

Lets explore two such exotic options given under short-term structures -

[1] Dual Currency Option Deposit (DCOD) – I have always felt that the DCOD is the easiest product to sell to any investor who doesn’t take the pain of thinking just a step ahead. The presentation say the following about the product (slide 8 and 9) – “a deposit offering the certainty of a boosted rate, well above the money market”, “it is a win-win situation”

Let me explain the structure in an example –

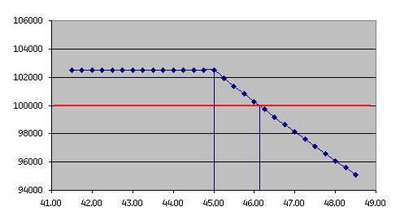

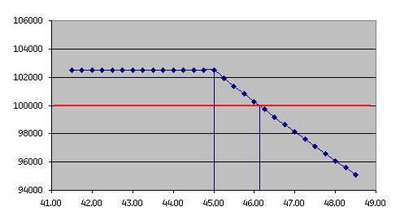

1. Assume the two underlying currencies are the US Dollar (USD) and the Indian Rupee (INR). The spot rate (USD/INR) is 45.50

2. Your investment in the structure is 100,000 USD (so the USD is the deposit currency for you and you measure your wealth in dollars, and not rupees)

3. The structure reads like, if the USD/INR rate is greater than 45.00 then you shall get 10% p.a. for the 3 month period in INR for your deposit amount i.e. Rs. 46,12,500. However, if the USD/INR rate goes below 45.00 then you shall still get 10% p.a. for the 3 month period but in USD i.e. USD 102,500.

For anyone, this might seems a rather harmless transaction as you shall always get 10% p.a. for your efforts – whichever currency you end up with. But if I put the specs in a matrix, the results are rather annoying for any investor –

[a] Note that the structure is similar to selling a put wherein your gains are limited, while your losses (on conversion of the rupees, back to dollars) can be unlimited. Notice how my overall gains become (4896.61) USD if the USD jumps up to INR 48.50. This is one aspect that the presentation misses out on. So although the pitch revloves around how FX-related investments can boost your returns, ironically it's the same movement in FX that can fetch you a negative return aswell.

[b] These structures are callable at the option of the issuer e.g. BNP Paribas. So, they can, on any fine morning tell you to round off the numbers as they are closing the product. No surprises, why they may do so.

[c] Notice, no one will say if the principal is protected or not. As you have, now deduced that although this product WILL fetch you the 10% p.a. return HOWEVER WILL NOT guarantee you protection of capital invested. Interesting concept, ain’t it?

[2] Corridor Double Knock Out Deposit (CDKOD) – Unlike the DCOD where principal is not protected, this product guarantees capital (it’s true). The product defines a range within which the FX rate (e.g. EUR/USD) should operate. E.g. the lower and upper limit of the EUR/USD is fixed at 1.22 and 1.32 (the current exchange rate is 1.27). So as long as exchange rate stays between 1.22 and 1.32, the investor would get an 8.00% p.a. interest for that day. However, if on any day the exchange rate breaches the limits then the investor will not get any interest for that day.

So the trade off matrix for investors here is [min=0.00%; max=8.00%; @ 8.00%*n/N] ;

where n = number of true observations; N = number of all observations

Here's something more I learnt about structures while going through some text on the internet -

a) 70% of all structures floated get ‘called’ within the 9 months of issuance and 90% of all structures within one-and-a-half years of issuance.

b) These structures are created as a money mobilization mechanism for investment firms. Now since they can’t just take big monies without making a challenge out of it, these deposit + derivative products are designed. The same investment firms which garner these 'high-yielding' monies make nothing less than 20% p.a. by deploying it in various other alternate investment areas …. and this has been happening for the last 200 years and more.

In a few years from now (2-3 yrs), such products would enter the Indian investment diaspora also as more companies will offer the same and hybrids of these products.

Lets explore two such exotic options given under short-term structures -

[1] Dual Currency Option Deposit (DCOD) – I have always felt that the DCOD is the easiest product to sell to any investor who doesn’t take the pain of thinking just a step ahead. The presentation say the following about the product (slide 8 and 9) – “a deposit offering the certainty of a boosted rate, well above the money market”, “it is a win-win situation”

Let me explain the structure in an example –

1. Assume the two underlying currencies are the US Dollar (USD) and the Indian Rupee (INR). The spot rate (USD/INR) is 45.50

2. Your investment in the structure is 100,000 USD (so the USD is the deposit currency for you and you measure your wealth in dollars, and not rupees)

3. The structure reads like, if the USD/INR rate is greater than 45.00 then you shall get 10% p.a. for the 3 month period in INR for your deposit amount i.e. Rs. 46,12,500. However, if the USD/INR rate goes below 45.00 then you shall still get 10% p.a. for the 3 month period but in USD i.e. USD 102,500.

For anyone, this might seems a rather harmless transaction as you shall always get 10% p.a. for your efforts – whichever currency you end up with. But if I put the specs in a matrix, the results are rather annoying for any investor –

[a] Note that the structure is similar to selling a put wherein your gains are limited, while your losses (on conversion of the rupees, back to dollars) can be unlimited. Notice how my overall gains become (4896.61) USD if the USD jumps up to INR 48.50. This is one aspect that the presentation misses out on. So although the pitch revloves around how FX-related investments can boost your returns, ironically it's the same movement in FX that can fetch you a negative return aswell.

[b] These structures are callable at the option of the issuer e.g. BNP Paribas. So, they can, on any fine morning tell you to round off the numbers as they are closing the product. No surprises, why they may do so.

[c] Notice, no one will say if the principal is protected or not. As you have, now deduced that although this product WILL fetch you the 10% p.a. return HOWEVER WILL NOT guarantee you protection of capital invested. Interesting concept, ain’t it?

[2] Corridor Double Knock Out Deposit (CDKOD) – Unlike the DCOD where principal is not protected, this product guarantees capital (it’s true). The product defines a range within which the FX rate (e.g. EUR/USD) should operate. E.g. the lower and upper limit of the EUR/USD is fixed at 1.22 and 1.32 (the current exchange rate is 1.27). So as long as exchange rate stays between 1.22 and 1.32, the investor would get an 8.00% p.a. interest for that day. However, if on any day the exchange rate breaches the limits then the investor will not get any interest for that day.

So the trade off matrix for investors here is [min=0.00%; max=8.00%; @ 8.00%*n/N] ;

where n = number of true observations; N = number of all observations

Here's something more I learnt about structures while going through some text on the internet -

a) 70% of all structures floated get ‘called’ within the 9 months of issuance and 90% of all structures within one-and-a-half years of issuance.

b) These structures are created as a money mobilization mechanism for investment firms. Now since they can’t just take big monies without making a challenge out of it, these deposit + derivative products are designed. The same investment firms which garner these 'high-yielding' monies make nothing less than 20% p.a. by deploying it in various other alternate investment areas …. and this has been happening for the last 200 years and more.

In a few years from now (2-3 yrs), such products would enter the Indian investment diaspora also as more companies will offer the same and hybrids of these products.

3 Comments:

Hello shankar,

This comment is not related to the above blog,writing it here so that you take notice of it,Yaar in one of ur previous blogs there was a discussion regarding investing in real estate sector,you mentioned that pre launch offers of good builders may give a annualized return of 600%,yesterday i was sitting in a property dealer's office when a person came and asked the dealer to help him sell his flat which he has booked with UNITECH group,the discussion which followed just rattled me up,the poor guy has grabbed the pre launch offer about six months back at 2015 rs per sq ft and some 1600 feets of it,Now the dealer says that he can get at max 2100 for him.The poor guy was ready as he was not in a position to pay the forthcoming installment.After he went back i had a small discussion with the dealer regarding property buisness,flat occupancy etc.i was shell shocked to know when he told me that the occupancy rate in flats is just under 35%.What i made out from all this was that the no. of flats are much more that people who actually need flats, the pocession of the flats just change hands from profit point of view, with this kind of scenario it seems that the tenfold hike that we witnessed in the last couple of years is now at its fag end.

Your comments are awaited.

Regards.

Dear Amit,

Can you email me the details of the property and the transaction on shankarnath at gmail dot com? I would like a second opinion on this from a different brokers.

Warm Rgds

Shankar

Mar-28: The RBI has now capped the FCNR (B) deposit rates to the Libor, thereby increasing the deposit rate by another 25 bps.

This is good news for the NRIs. All NRIs should check back, if they have renewed any of their deposits in India over the last 3-4 months and for a period of 3 years .. should cancel the same and renew it on the new FCNR rate

Rgds, Shankar

Post a Comment

<< Home