Polaris in the RED, but are you thinking ....

A Tale of Two Cities .... One city is called "Polaris HUMBLE-BE" and the other is known as "Polaris BUBBLE-BE".

Polaris Humble-be is a representation of the financial records of Polaris Software Labs i.e. the kind of thing. shareholders are concerned with - return on capital invested. Polaris Bubble-be is a news driven city where everything depends on the whims and fancies of inputs given by the news agencies. Here a glorious example in the making ....

Polaris Humble-Be:

1. Comparing the quarterly data of FY05 and FY06, I find -

a) Q1: Polaris PAT down 57% from FY05 numbers

b) Q2: Polaris PAT down 47% from FY05 numbers

c) Q3: Polaris PAT is negative. Losses of 7.54 crs (compared to 12.08 crs LY)

2. From a value perspective -

a) NCAV = 21.75 rupees per share

b) Debt free company

c) LY Dividend = 1.75 on a 5 rupees share. This year, I expect the company to give zero dividend because of the low profits.

d) Low cash reserves of 3.93 rupees per share

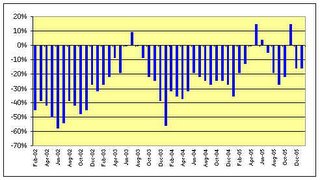

3. Share price charting at BSE ......

Here's a comparison of shares bought in various months and returns (excl dividend and assumed: if held till date) -

The graph clearly illustrates how the Polaris scrip has managed to give positive returns in only 4 months out of 48. (Hey.. i just remembered ... in my last job, this is how I used to sell hedge funds ... the investors used to get confused with so many graphs)

So Polaris was truly, a shareholder's nightmare.

Now, lets look at Polaris BUBBLE-BE :

Something is happening at Polaris and they are putting enough news in the air to make it count. Here are some news stories in review -

1. Polaris is ranked Best in the category for "specialty Application Development" (link)

2. Microsoft chooses Polaris as a Launch Partner in India for VS 2005 and SQL Server 2005 (link)

3. Polaris Software signs up Lloyds TSB for INTELLECT SUITE (link)

4. Polaris launches Collect.net (link)

This was major news till November 0f 2005. However one very interesting piece of news that hit the papers (The Hindu Business Line) on 10-Jan 2006 was when McKinsey submitted it's proposals to Polaris ... "stay focused on the legacy modernization services, where one sees big growth in the financial services space".

Lesson for us - At 109 rupees, Polaris Software Labs Ltd. is enticing. There are positive news in the vision/expansion/clients stream but the negative news are flowing in the financial areas. Graham would have been a NO-NO-NO for Polaris, but Warren Buffett might still tip in with a YES-YES-NO.

Whats your pick?

Polaris Humble-be is a representation of the financial records of Polaris Software Labs i.e. the kind of thing. shareholders are concerned with - return on capital invested. Polaris Bubble-be is a news driven city where everything depends on the whims and fancies of inputs given by the news agencies. Here a glorious example in the making ....

Polaris Humble-Be:

1. Comparing the quarterly data of FY05 and FY06, I find -

a) Q1: Polaris PAT down 57% from FY05 numbers

b) Q2: Polaris PAT down 47% from FY05 numbers

c) Q3: Polaris PAT is negative. Losses of 7.54 crs (compared to 12.08 crs LY)

2. From a value perspective -

a) NCAV = 21.75 rupees per share

b) Debt free company

c) LY Dividend = 1.75 on a 5 rupees share. This year, I expect the company to give zero dividend because of the low profits.

d) Low cash reserves of 3.93 rupees per share

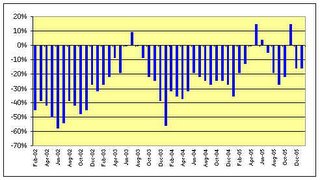

3. Share price charting at BSE ......

Here's a comparison of shares bought in various months and returns (excl dividend and assumed: if held till date) -

The graph clearly illustrates how the Polaris scrip has managed to give positive returns in only 4 months out of 48. (Hey.. i just remembered ... in my last job, this is how I used to sell hedge funds ... the investors used to get confused with so many graphs)

So Polaris was truly, a shareholder's nightmare.

Now, lets look at Polaris BUBBLE-BE :

Something is happening at Polaris and they are putting enough news in the air to make it count. Here are some news stories in review -

1. Polaris is ranked Best in the category for "specialty Application Development" (link)

2. Microsoft chooses Polaris as a Launch Partner in India for VS 2005 and SQL Server 2005 (link)

3. Polaris Software signs up Lloyds TSB for INTELLECT SUITE (link)

4. Polaris launches Collect.net (link)

This was major news till November 0f 2005. However one very interesting piece of news that hit the papers (The Hindu Business Line) on 10-Jan 2006 was when McKinsey submitted it's proposals to Polaris ... "stay focused on the legacy modernization services, where one sees big growth in the financial services space".

Lesson for us - At 109 rupees, Polaris Software Labs Ltd. is enticing. There are positive news in the vision/expansion/clients stream but the negative news are flowing in the financial areas. Graham would have been a NO-NO-NO for Polaris, but Warren Buffett might still tip in with a YES-YES-NO.

Whats your pick?

4 Comments:

Dude,

Polaris would be a definite No No cos there are so many other fish out there giving great returns - Many say even stocks like Infy are a buy at these levels (expected to touch 4k,etc,etc).

Noce one on PNB.. Good job mate!

Cheers,

Sai

Hi Sai, i'd agree with you. I dont mind paying double the price to see a company with a strong P&L, cash reserves rather than news stories. Do suggest some good infotech stocks.

Rgds, Shankar

I will like to know your views in wake of a market crash,suppose in case,if the market falls to 8500 levels in the next few days, what will be the impact of it on the shares suggested by you,like on bhagyanagar,elgitread, polaris(in fact not suggested), pnb gilts and then also shares like rajesh export about which i read in one of the other good blogger's space.....no offences meant.....just wanted to know the fate of these stocks in wake of crisis and their strength in coming back once the going gets smooth..........

Raviprasad

Hi Raviprasad,

The entire premise of value investing is based on the conservative investor. So there is a lower probability of value stocks going down as compared to other stocks which are on shaky fundamentals (pl note, all stocks do go down as the market is often guided by human psychology rather than reason). Here's where Graham has beautifully described the situation - "In the short run, the market operates as a voting machine ... in the long run, the market operates like a weighing machine".

The stocks suggested have a fairly low P/E ratio and a high NCA/CMP ratio. ...

a) Bhagyangr - PE of 3.56 and NCA/CMP of 0.60

b) PNB Gilts - PE of 5.6 and NCA/CMP is 1.61

c) Elgitread - PE of 14.5 and NCA/CMP of 0.54

Compare this with the more popular ones .....

a) Titan - FwdPE of 95

b) Wipro - FwdPE of 74

c) ABB - FwdPE of 41

d) Siemens - FwdPE of 48

"I guess cars with crash helmets will survive the crash better ... but they would crash too."

Warm Rgds, Shankar

Post a Comment

<< Home