This blog is in response to

Prasanth's comments. Prasanth found these stocks enlisted in the

capitalideasonline round table. Enclosed is my evaluation of the same -

1. India Nippon Electricals The evaluation in numbers –

NCAV (incl invts) – 97.14 rupees per share

Dividend – 8.50 rupees per share

FV – 10 rupees

There is nothing exciting about this stock, neither is there anything I feel rather uncomfortable about. The sales are rather constant, so are the profits. At a CMP of 276 rupees per share (Feb-14) and a fwdPE of 12.50, the stock is attractive enough. The dividend yield is also a decent 3.08%. It’s a fairly stable stock which has had rather minor swings over the last 12 months (the highest being a rise from 245 to 300 in 30 days). There is a fair chance of the stock going up in the next 5-6 weeks with moderate returns of 12-20%.

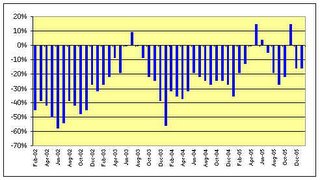

2. Cheviot Company Ltd.A similar company to India Nippon Electricals, Cheviot has an NCAV (incl invt) of 225.98 on a CMP of 512.00 which is very decent. I approximate the fwdPE of this stock to be 6.42 and is currently at a dividend yield of 1.95%. The big spike in the Cheviot stock came in the month of August 2005 when it jumped up from 330 rupees to 600 rupees in 20 days; otherwise the going has been easy over the last 4 months. Very stable - sales and profits – not too exciting from a company standpoint, but a little under valued. I would not be able to comment on further movements in this stock, although there is a higher probability of the stock going up rather than down.

3. Investment and Precision Castings A stock I held at one time (bought at 275, sold in a month at 525) and still retain one share (I tend to retain one share, because I get the annual report of the company then). Before dwelling on the financials, my advice is to not invest in stocks where the profit per quarter is very low. In this case, we are looking at close to 2 crores per quarter or 66 lakhs a month. This was one factor for me to move out of this stock. Surely one cant be comfortable with such a company. The business stats are enclosed –

a) NCAV – 126.61 rupees

b) CMP – 617.00 rupees

c) FwdP/E – 9.56

d) Dividend yield – 1.22%

4. Fem Care Pharma Just the kind of stock you should never buy. A truly un-Graham stock with no “margin of safety”. Its more of a “Value shock” rather than a “Value Stock”. Examine these –

a) It has an NCA per share (incl invt) of 1.12 rupees per share against a CMP of 428 rupees

b) The company has never given a dividend in the last 5 years, except the last yr when it shelled out 5.1 rupees per share

c) The stock is at a fwdPE of 16.10 which is also very high

d) Sales and profits are growing at a miserly 15-20%

5. Motherson Sumi Systems LtdA good profitable company with expanding sales, Motherson Sumi is an evolved and fairly valued stock. The business stats of the same are enclosed –

NCAV – negative 1.67 / share

CMP – 82.00 rupees per share

FV – 1 rupee per share

Div. Yield – 1.22%

Profit (LY) – 62.09

P/E of 31.02 and fwd P/E of 27.92

An excellent company with a good management, the stock is largely overpriced given the specs above. Advise buy only if the stock goes down to around rupees 60.

In summary, Cheviot Company Ltd. seems to be the best buy of the 5 stocks listed. For it's stable revenues, stable profits, good NCA/CMP ratio, management and P/E ratio.

First impressions may read the following numbers -

First impressions may read the following numbers -